Businesses worldwide lose approximately 5% of their earnings to fraud each year –Association of Certified Fraud Examiners 2022 Survey. Often, the causal factor is a lack of proper financial oversight.

An important preventative measure to deal with such fraud is reconciliation of accounts. By comparing two sets of data like bank statements, ledger, etc., reconciliation ensures that any error or omission comes to light.

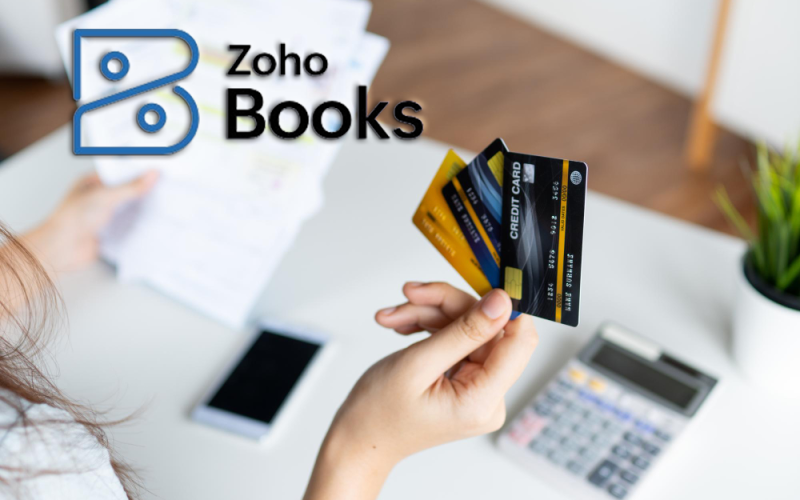

Regular reconciliation of bank and credit card accounts is especially important. But why should you reconcile bank and credit card statements if you use software like Zoho Books? While Zoho Books Software imports data in real-time, the possibility of human error still cannot be ruled out.

What is Zoho Books Software

Zoho Books software is one of the most trending and an incredible accounting software that can manage all the accounting tasks of your business. It helps in securely organising all your business transactions. You can easily

- track all your invoices and bills,

- reconcile bank statements,

- control your expenditure,

- ensure GST compliance, and

- oversee projects, etc.

Streamline your accounting with Zoho Books!

Why Reconciliation Matters in Zoho Books

Although Zoho Books imports balances and transaction data in real time, there is always the possibility of errors creeping in.

For instance, Zoho Books automates transaction entries and labels them as “Manually Added” on your “All Transaction” page. Users can categorise or match transactions during this process, ensuring systematic tracking. Despite this, human error can still occur. Reconciliation helps by identifying any inadvertent mistakes.

Let us consider another scenario regarding pending transactions. With Zoho Books, keeping track of your pending transactions is easy. Whether it’s outstanding checks or deposits, you can see them all at a glance. If a check from a vendor hasn’t gone through for a while, you’ll know right away thanks to real-time tracking. This helps you stay on top of things and reach out to vendors or customers as needed. Reconciliation keeps you updated on these transactions, so you can take action when necessary.

Here is why you should be reconciling accounts in Zoho Books:

1.Accuracy in Financial Records

When you reconcile your bank and credit card statements in Zoho Books, you ensure that any errors or omissions come to your notice. It is possible that some entry has been made twice, an entry has been omitted, or some amount has been wrongly recorded, etc.

2.Preventing Frauds

There are several reports that point out that frauds are common in businesses of all scales leading to considerable losses for it. It is wise that precautionary and preventive measures are taken like reconciling accounts to identify anything that can be a cause of concern. Zoho Books reconciliation will help you find out any suspicious transactions made through the bank.

3.Better Business Decisions

The accuracy of financial records is quintessential as key business decisions rely on this data. As we understood above, reconciliation of your bank and credit card accounts will ensure that nothing is missed, under-reported, or overcharged. Any suspicious entry will also come to light. Corrective measures can then be taken to ensure the accuracy of financial records. This will ensure that decision-making is based on the right data.

4.Improved Cash Flow Management

When you reconcile your bank and credit card statement, you understand the pattern of inflow and outflow of cash. You become aware of areas where mistakes occur while recording transactions. You stay on top of things like which vendor’s payment has been sue for a while, etc. This helps in better cash management.

5.Compliance

By keeping accurate financial records and reconciling your accounts often, you will meet the legal requirements. By taking care of any errors and omissions you will ensure that your accounts are a true statement of your business’s affairs. Compliance is essential for audits, financial reporting, and for maintaining stakeholder trust.

Using Zoho Books for Easy Reconciliation

So, why should you leverage Zoho Books for reconciliation purposes?

- Auto-Upload Your Bank Statements: Automatically upload your bank statements from your email to ensure all transactions are included in your reconciliation.

- Easy Transaction Investigation: Hyperlink into each transaction during reconciliations to quickly investigate any discrepancies.

- Automated Payments and Transfers: Zoho Books integration with various payment methods generates payments and transfers automatically, making transaction matching easier.

- Effortless Expense Categorization: With Zoho Expense, employees can categorise their corporate card expenses on-the-go, ensuring accurate reflection of your financial status during reconciliation.

· Real-Time Updates and Notifications: This ensures that you are aware of instances that require your immediate attention and you can address them promptly.Reconciliation made simple with Zoho Books!

How to Reconcile Accounts in Zoho Books

Now let us understand how to reconcile accounts in Zoho Books:

- On the left sidebar you will find the ‘Banking’ module. Go to it.

- Select the account for which transactions have to be reconciled.

- Next you need to click on the ‘Gear’ button. It will be on the page’s top right corner.

- Choose ‘Reconcile Account’.

- You precisely need to select ‘Initiate Reconciliation’.

- Provide the ‘Start Date’ and ‘End Date’ of your reconciliation time period.

- Choose ‘Start Reconciliation’.

- Choose the transactions that you want to reconcile.

| Note: It is important that the difference between Closing Balance and Cleared Account is zero, i.e. they are the same. Only then you will be able to reconcile the accounts. If need be, edit the closing balance by simply clicking on the ‘Edit’ icon where the closing balance is mentioned. Enter the new amount and then click on ‘Update’. |

9.Once you are done with the reconciling process, click on ‘Reconcile’. It will finish the process.

10.The process can also be postponed by clicking on ‘Save and Reconcile Later’.

| Pro-Tip: Upload a file from your computer/cloud if you need to add more details for reconciliation |

Efficient reconciliation, step by step!

Conclusion

Today, we learned some of the essential reasons why reconciling bank and credit card accounts is essential in Zoho Books. We hope this blog is going to dispel all your doubts regarding reconciling in Zoho Books. You are free to choose the period for which you want to reconcile the accounts. You can reconcile accounts every month or for a reporting period.

Still need help? Schedule a free demo with a trusted Zoho Integration Partner. Understand how Zoho Books can manage all accounting tasks in your organisation and provide your business with a competitive edge.